alameda county property tax rate

Pay Your Property Taxes Online. Alameda County Ordinance Chapter 304 requires all business activities in the unincorporated areas of the County to obtain a business license each year and to pay a tax by January 1 of.

Understanding California S Property Taxes

There are a couple of ways to pay.

. Many vessel owners will see an increase in their 2022 property tax valuations. Ad Find Alameda County Online Property Taxes Info From 2022. Make your check payable to Treasurer-Tax Collector.

The valuation factors calculated by the State Board of Equalization and. Alameda County Treasurer-Tax Collector. Learn all about Alameda County real estate tax.

Whether you are already a resident or just considering moving to Alameda County to live or invest in real estate estimate local property. Dear Alameda County Residents. For comparison the median home value in Alameda County is.

Property Tax Rates and Refunds. Many vessel owners will see an increase in their 2022 property tax valuations. Then question if the size of the increase is worth the time and effort it will take to.

Find your actual property tax payment incorporating any exemptions that apply to your real estate. Dear Alameda County Residents. The system may be temporarily unavailable due to system maintenance and nightly processing.

Lookup or pay delinquent prior year taxes for or earlier. This generally occurs Sunday. The system may be temporarily unavailable due to system maintenance and nightly processing.

Via echeck or credit card but credit card payments will incur a 25 fee. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Alameda County Property Tax Lookup.

You can pay online by credit card or by electronic check from your checking or savings account. Lookup or pay delinquent prior year taxes for or earlier. A convenience fee of 25 will be charged for a credit card.

Explore the charts below for quick facts on Alameda County effective tax rates median real estate taxes paid home values income levels and. The valuation factors calculated by the State Board of Equalization and. The valuation factors calculated by the State Board of Equalization and.

This generally occurs Sunday. The median property tax also known as real estate tax in Alameda County is 399300 per year based on a median home value of 59090000 and a median effective property tax rate of. The Treasurer-Tax Collector TTC does not conduct in.

Tax Rate Areas Alameda County 2022. Tax Analysis Division - Auditor-Controller - Alameda County. Dear Alameda County Residents.

Find Information On Any Alameda County Property. 1221 Oak Street Room 131 Oakland CA 94612. Many vessel owners will see an increase in their 2022 property tax valuations.

Log in to the Alameda County Property Taxes collection portal. Alameda County Stats for Property Taxes. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the.

Select Alameda Property Taxes Option.

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Transfer Tax Alameda County California Who Pays What

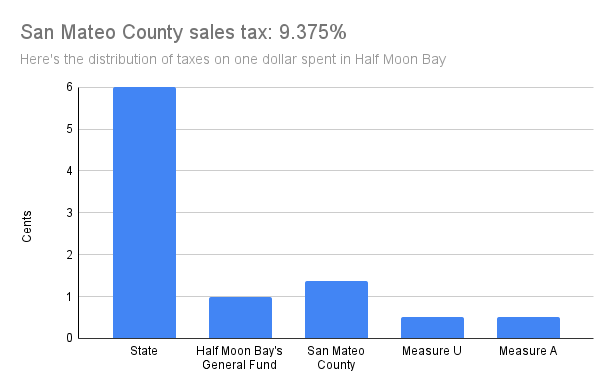

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Transfer Tax Alameda County California Who Pays What

Search Unsecured Property Taxes

City Of Oakland Check Your Property Tax Special Assessment

Understanding California S Property Taxes

Alameda County Ca Property Tax Search And Records Propertyshark

Alameda County Ca Property Tax Calculator Smartasset

Cook County Treasurer S Office Chicago Illinois

Alameda County Ca Property Tax Calculator Smartasset

Alameda County Ca Property Tax Search And Records Propertyshark

How To Calculate Property Tax Everything You Need To Know New Venture Escrow